Growing Your Business from Acre to Asset

Transformative Digital Agriculture Solutions for Marketing to Delivery

Sales, Marketing & Operations

• Targeted marketing and advertising

• Streamline and enrich data to improve prospecting

• Use data to evaluate and expand your business

Institutional Investors & Farm Managers

• Manage farmland at scale

• Digitize land management

• Decide which assets to purchase and sell

Rural Appraisers & Brokerages

• Manage your comp database

• Create and access comps

• Quickly assess the value of farmland

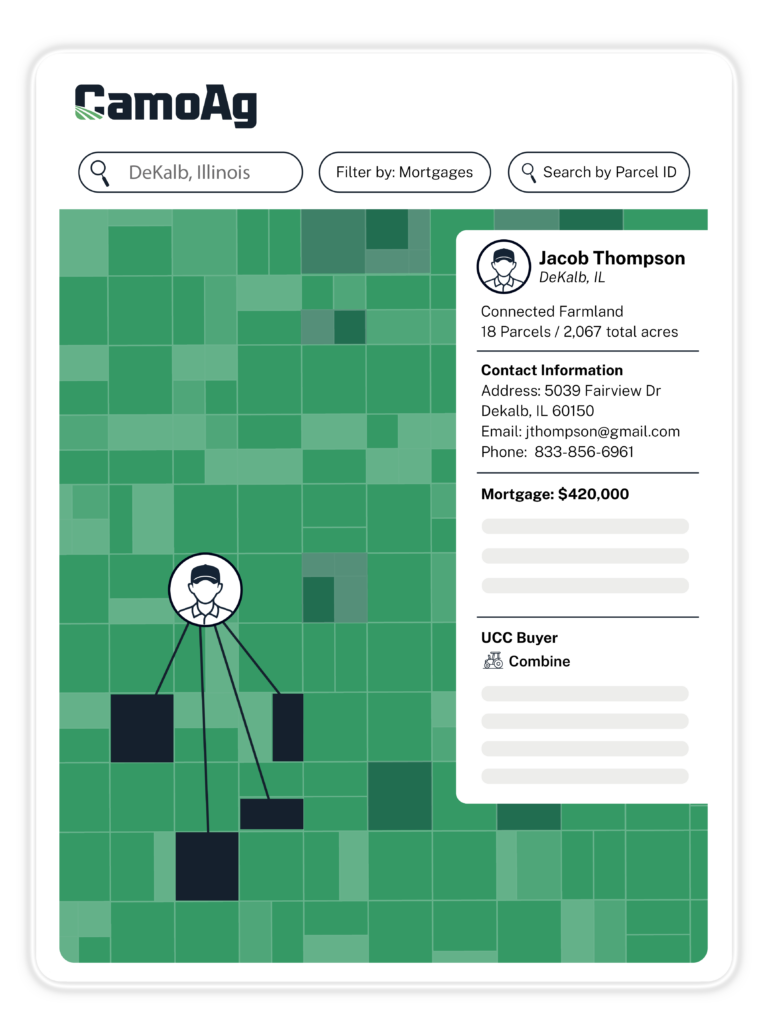

Deep, contextual farmer and landowner insights in a single place

Client Intelligence

Actionable farmer, land, and asset information at the touch of a button.

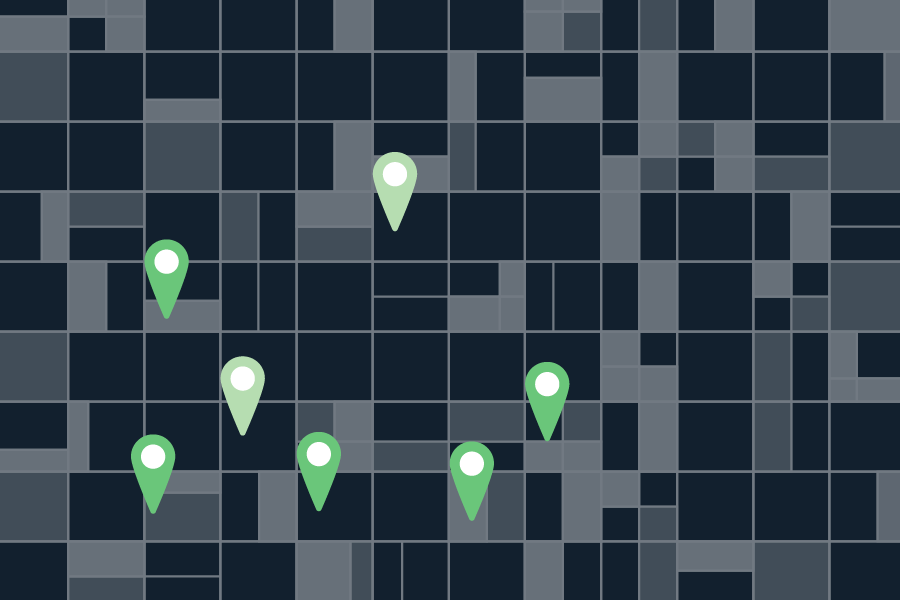

Comp Tool

Get a quick, complete picture of a parcel’s market value based on the property data and broader market trends.

Land Platform

Manage farmland at scale by digitizing your workflows and analyzing your portfolio with ease.

Cutting-edge Tech Meets Time-honored Tradition

We know all about agricultural land — and we know that it can be managed better. Our flexible suite of digital tools equip ag businesses like yours to:

Dig into diverse sets of farm data

Tend to business processes with intuitive digital solutions

Yield better results for your business and clients

Book a Demo

See how CamoAg’s technology can take your business into the next generation of digital agriculture.

Time-tested Tools, Tailored to You

CamoAg’s suite of tools use tested approaches from residential real estate, and commercial lending, and can be tailored to meet your business’ unique needs. They integrate with your existing platforms and leverage your proprietary data. They also provide the option to access new data sources and powerful new reporting tools.

Strength In Numbers

Million Parcels of Data

Acres of Data

Comp Sales

Transactions Completed